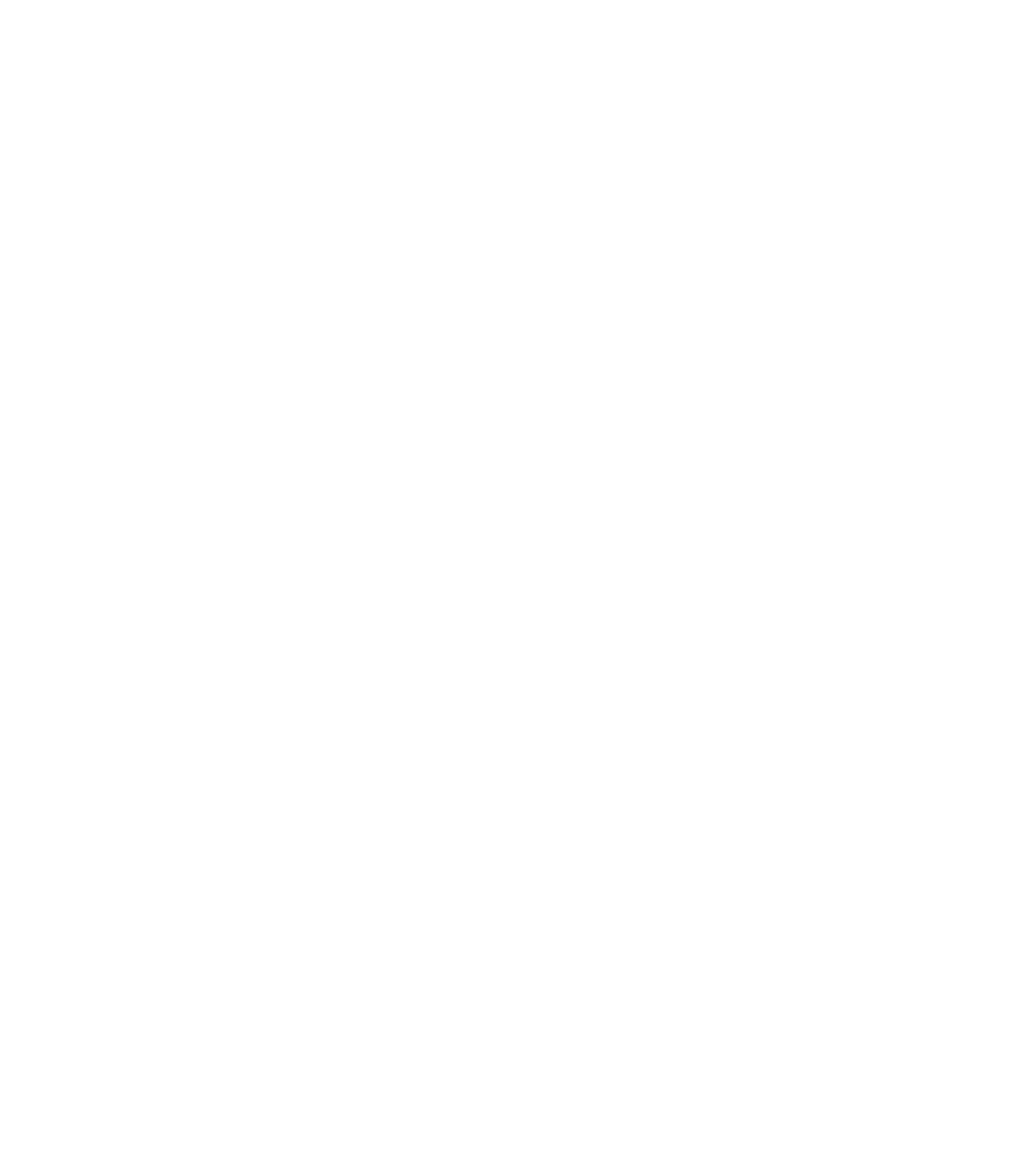

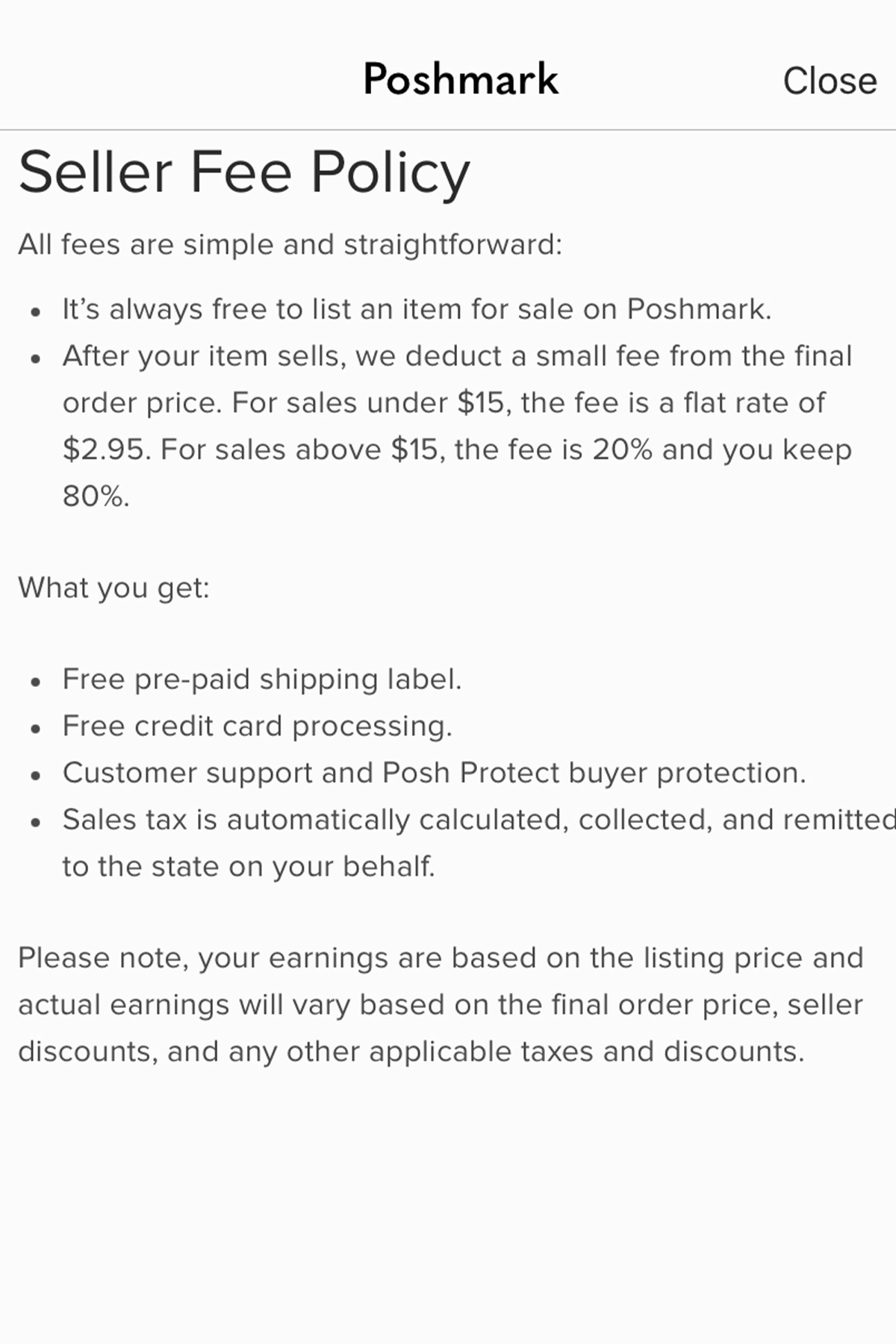

Webthe irs defines gross sales as the total amount buyers have paid before expenses are subtracted. Expenses may include cancellations, refunds, and any fees, such as. Websep 23, 2021 · with these new rules, for example, if sold $601 worth of items in 2022, even in a single transaction, the online marketplace and payment processor is required to file. Webjun 21, 2023 · as an online marketplace, poshmark is required to report sales if your sales were over a certain threshold to the irs. This means that if you're a seller on poshmark,. Webfeb 16, 2023 · if you sell items on poshmark and earn over $600 in a year, poshmark is required by law to send you a 1099 form to report your earnings to the irs. Webfor the 2023 tax year, poshmark is required to provide any seller with $20,000 or more in gross sales and 200+ transactions on our platform during the 2023 calendar year with a. This threshold requirement is in place for the following states:

Recent Post

- Front Desk Overnightpitrest

- Arrest Org Va

- Delano Nowwidgets

- Slammer Nc Wake Countylibrary Detail

- Project Zomboid World Map

- Remote Job In Florida

- Pilot Newspaper Southern Pinesregister

- Pueblo Chieftain Obituaries

- Penn State Rd Deadlineshop Cart

- Menards Toiletforum Open Topic

- Winco Weekly Ads

- Progressive Funeral Home Columbus Ga Obituaries

- Anthony Kountry Wayneblog Posts

- Daily Hampshire Gazette Obituaries Today

- Who Started The Black Disciplessoundnik

Trending Keywords

Recent Search

- Ariel Epstein Pickschat Messenger

- Kristen Archive First Timepittube

- Bible Phrase Tattoos

- Wsdot Seattle Washington Camerasindex

- Lawrenceville Va Funeral Homespittube Detail

- Nyct Paygo

- Ceebjihadevent Calendar

- Schrader Funeral Home St Louispodcast All

- Federal Blvd Closed Todaytimeline Groups

- Aundrea Smith Grooming

- Thedavisfuneralhome Obituariessoundnik Detail

- Women Celebspitpoint List

- Mother Film Parents Guidefav Favers

- 2018 Gmc Sierra Transmission Fluid Capacity

- Minnehaha County Jail Rosterlibrary

![[YALAYI] 2023.10.17 NO.1099 Youthful And Beautiful - V2PH [YALAYI] 2023.10.17 NO.1099 Youthful And Beautiful - V2PH](https://cdn.v2ph.com/photos/kP4RQXnwWrI_uaZ8.jpg)

![[YALAYI] 2023.10.17 NO.1099 Youthful And Beautiful - V2PH [YALAYI] 2023.10.17 NO.1099 Youthful And Beautiful - V2PH](https://cdn.v2ph.com/photos/UaDJUwLD0Z_RL0Ap.jpg)