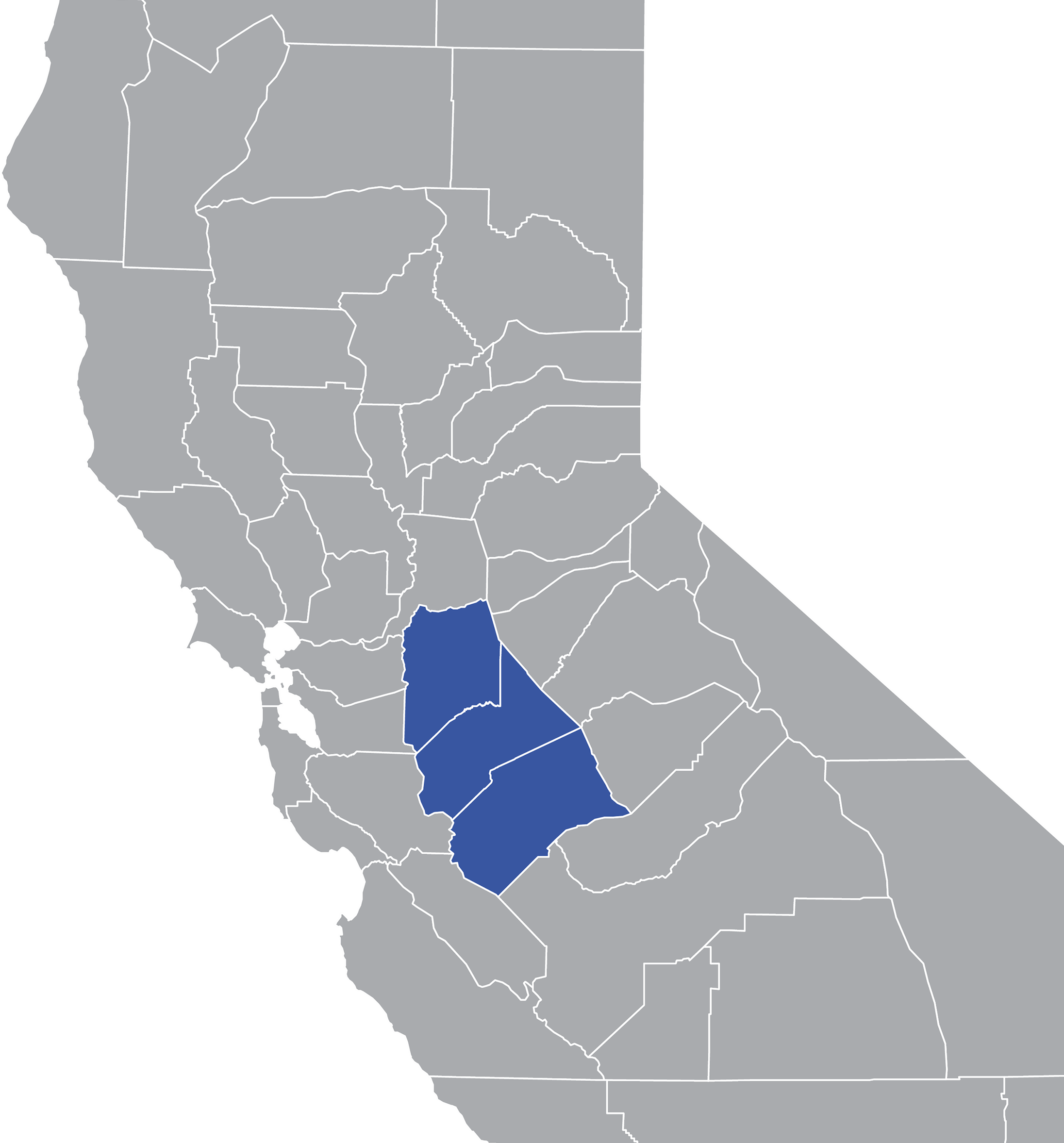

Webthe median property tax in san joaquin county, california is $2,340 per year for a home worth the median value of $318,600. San joaquin county collects, on average, 0. 73% of. Our mission is to ensure the safekeeping of public funds while. Webexplore the charts below for quick facts on san joaquin county effective tax rates, median real estate taxes paid, home values, income levels and homeownership rates, and. Weblearn all about san joaquin real estate tax. Whether you are already a resident or just considering moving to san joaquin to live or invest in real estate, estimate local. Webthe median property tax (also known as real estate tax) in san joaquin county is $2,340. 00 per year, based on a median home value of $318,600. 00 and a median effective. Weboverseeing the property tax billing and collection process for secured and unsecured property taxes levied by california state law, we assist the public in understanding their. Quickly find treasurer & tax collector phone number, directions & services (stockton, ca).

Related Posts

Recent Post

- Is Courtney Leaving Qvc

- Chris And Amanda Provost Daughter

- Ta Truck Stop Around Me

- What Happened To Andy Wyrick

- Busted Newspaper Opelika Al

- Winota Cedh Budget

- Free Printable Stretching Exercises For Seniors

- Burlington Ma Police Log

- Ppn News Rumble

- E2m Meal

- Emoryhealthcare Patient Portal

- Pop Crave Twitter

- Lauren Bajuk Obituaryfav Page Create Html

- Dr Jordan Peterson Personality Test

- Mega Churches In Georgia

Trending Keywords

Recent Search

- Little And Davenport Funeral

- Stacato Pistol

- Joel Osteen God Is In Control Of The Stormabout Html

- Restoring Galveston Airbnb

- Missing Nashville Man Found Dead

- Golds Gym Bar

- Kvue Youtube

- Obituary St Croix

- Ups Store Me

- Mugshots Mobile Al Latest Bookings

- Thrifty Nickel San Angelo Garage Sales

- Ups Freight Ship

- Christus Good Shepherd Mychart

- Ohio Shooting Ex Boyfriend

- Atlas Holding The World Tattoo Design

/state-income-tax-rates-2-2014-tax-foundation-57a631e35f9b58974a3ad3a4.png)