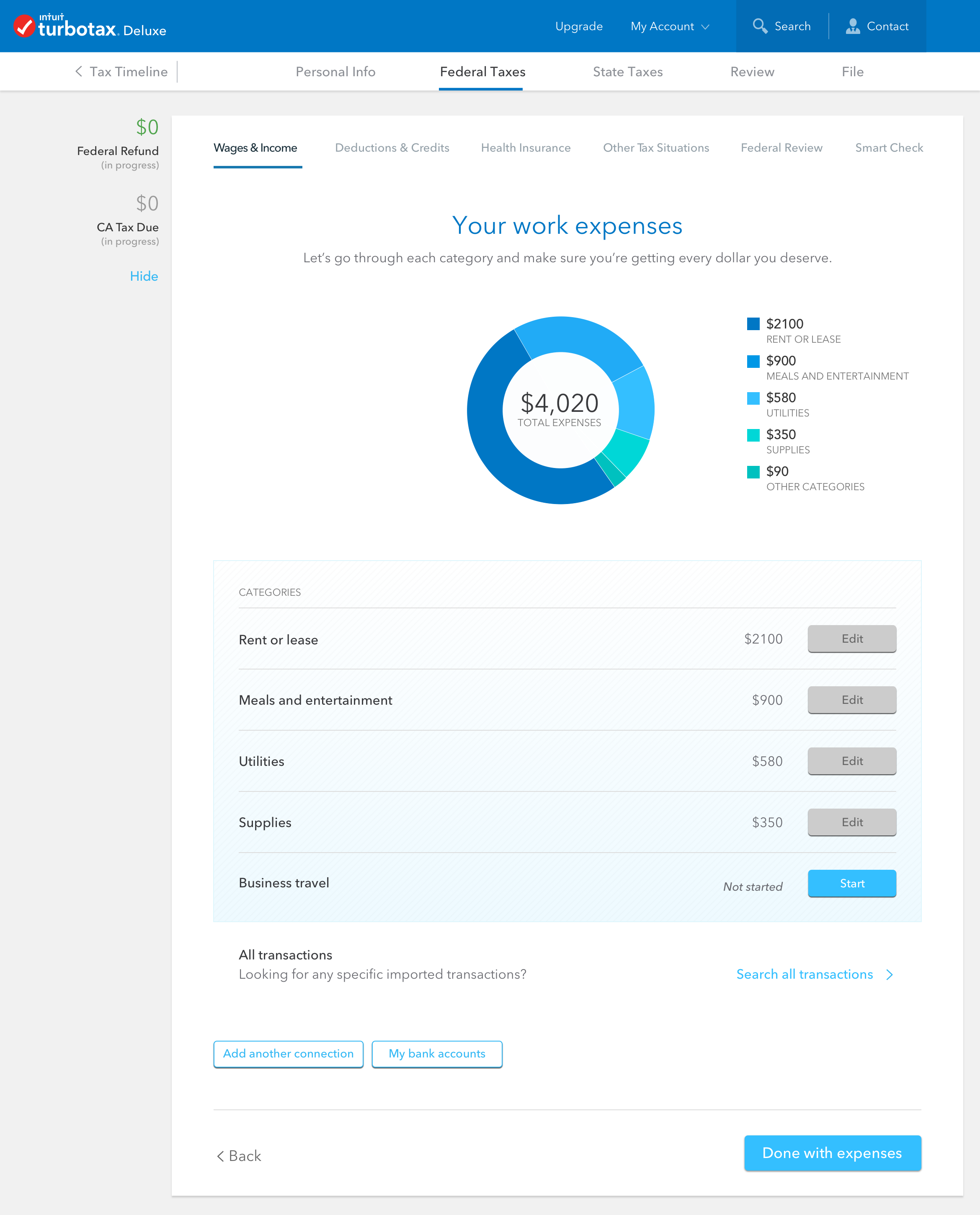

Webwe have reviewed the new york statute, implementing regulations, and applicable laws, caselaw and federal guidance, and we have consulted with the internal revenue. Webjun 7, 2019 · no. If you itemize your deductions, this is deductible on schedule a of your federal tax return. Webfeb 20, 2023 · no. Webas of january 1, 2018, most private and certain public employees who work in new york state are eligible to take paid family leave. If your employer participates in new york. Websep 8, 2017 · the new york state department of taxation and finance (“department”) recently released its guidance on the tax implications of the new york paid family. Weblearn how pfl is fully funded through employee payroll contributions and how to calculate deductions. Webnov 27, 2020 · for the last couple of years nys have being deducting premiums for the paid family leave program. This deduction shows in box 14 of the w2. Webeffective january 1, 2018, the program establishes a system of insurance for paid family leave (pfl) with the premium paid by employees through payroll deduction.

Recent Post

- Homes For Rent Under 700

- Fedex Espanol

- Community Tv Show Wikipedia

- Simi Valley Ca News

- Dallas Georgia News

- Uci Class Of 2028 Acceptance Rate

- Ali Velshi Reads Full Indictment

- Create Nfl Mock Draft 2024

- Safeway Pick Up

- Steve Harvey Motivational Concert

- Coach T Message Board

- Jacksonville Florida Zillow

- Xzillow

- Cell Membrane Quizlet

- Facebook Marketplace Grants Pass Oregon

Trending Keywords

Recent Search

- Crucible Act 3 Quizlet

- Indeed Rochester Ny Part Time

- Breast Expansion

- Espn Sports Fantasy Football

- Indeed Jobs Az Phoenix

- Shooting In Chandler Az

- Which Nims Structure Makes Cooperative Multi Agency Decisions Quizlet

- Good Mugshots

- Mars Hill Network Playlist

- Recent Arrests In Broward County Florida

- Casey Ladelle Towing

- Logan County Arkansas Inmate Roster

- Ups Package Handler Salary Part Time

- Initiation Fee Planet Fitness

- What Is Targeted Individuals

+CategorySummary+-+Universal+search.png?format=1500w)

![turbotax Tim On Twitter: "[#rtvs] Who Are They Waiting For? Only You turbotax Tim On Twitter: "[#rtvs] Who Are They Waiting For? Only You](https://pbs.twimg.com/media/FcavOgyWQAEjaln?format=jpg&name=large)