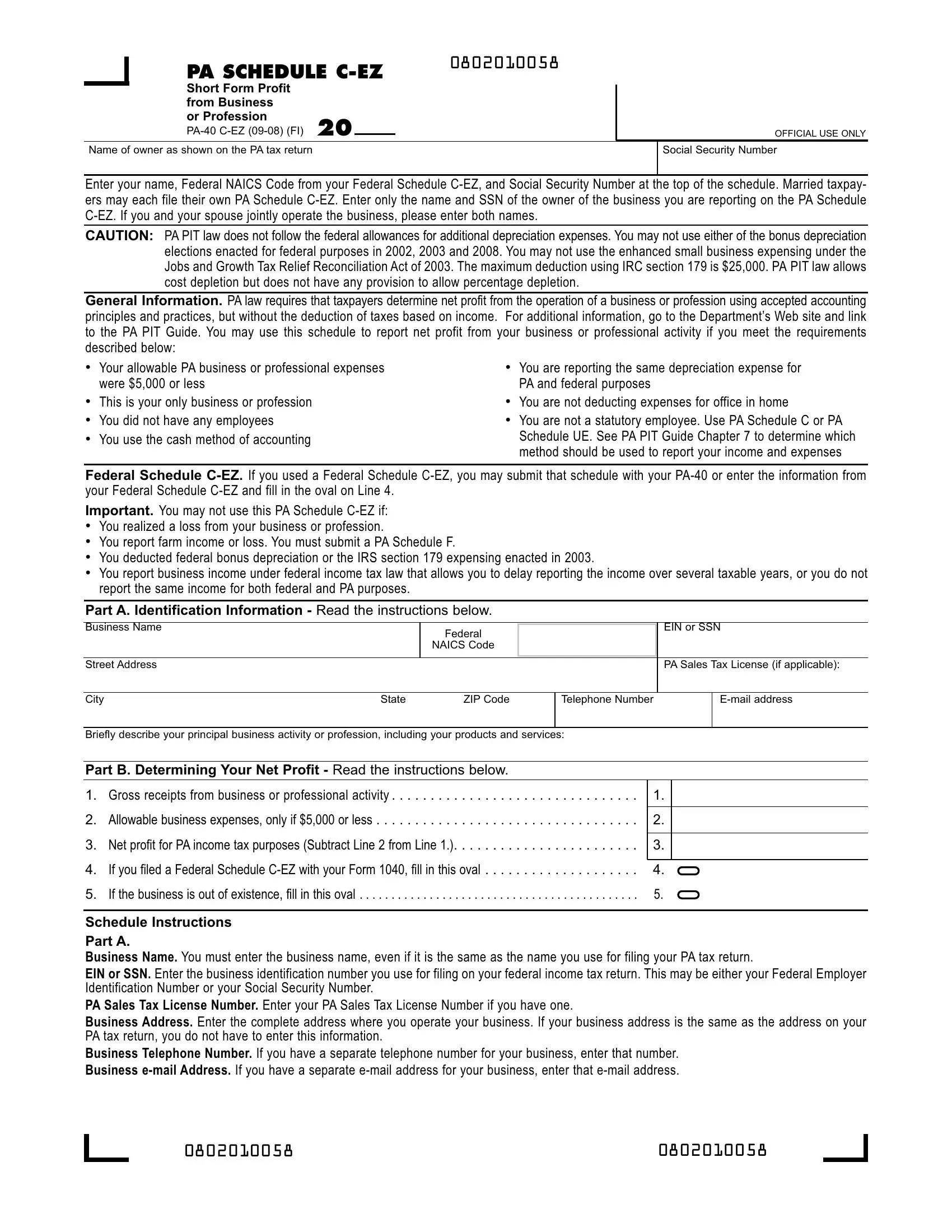

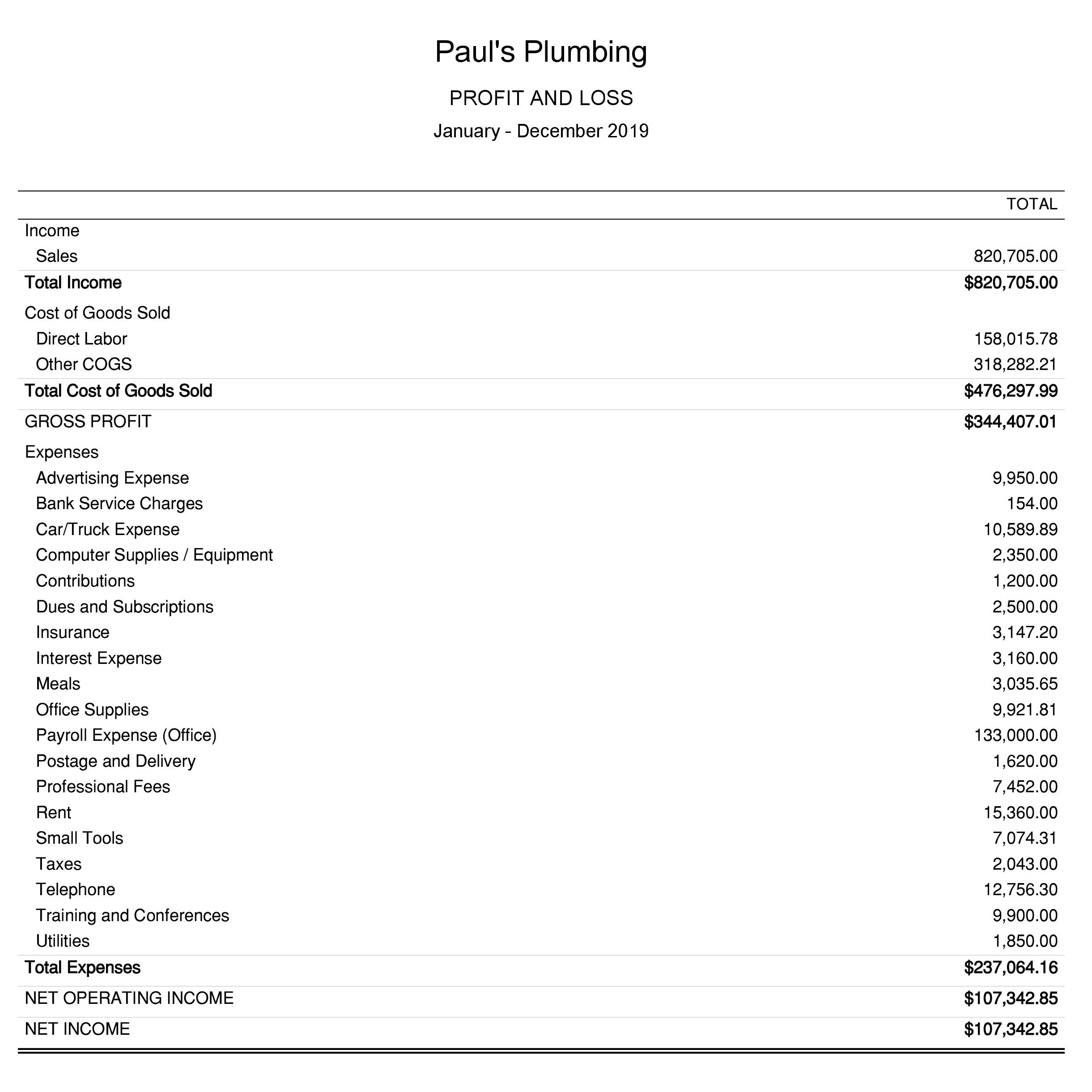

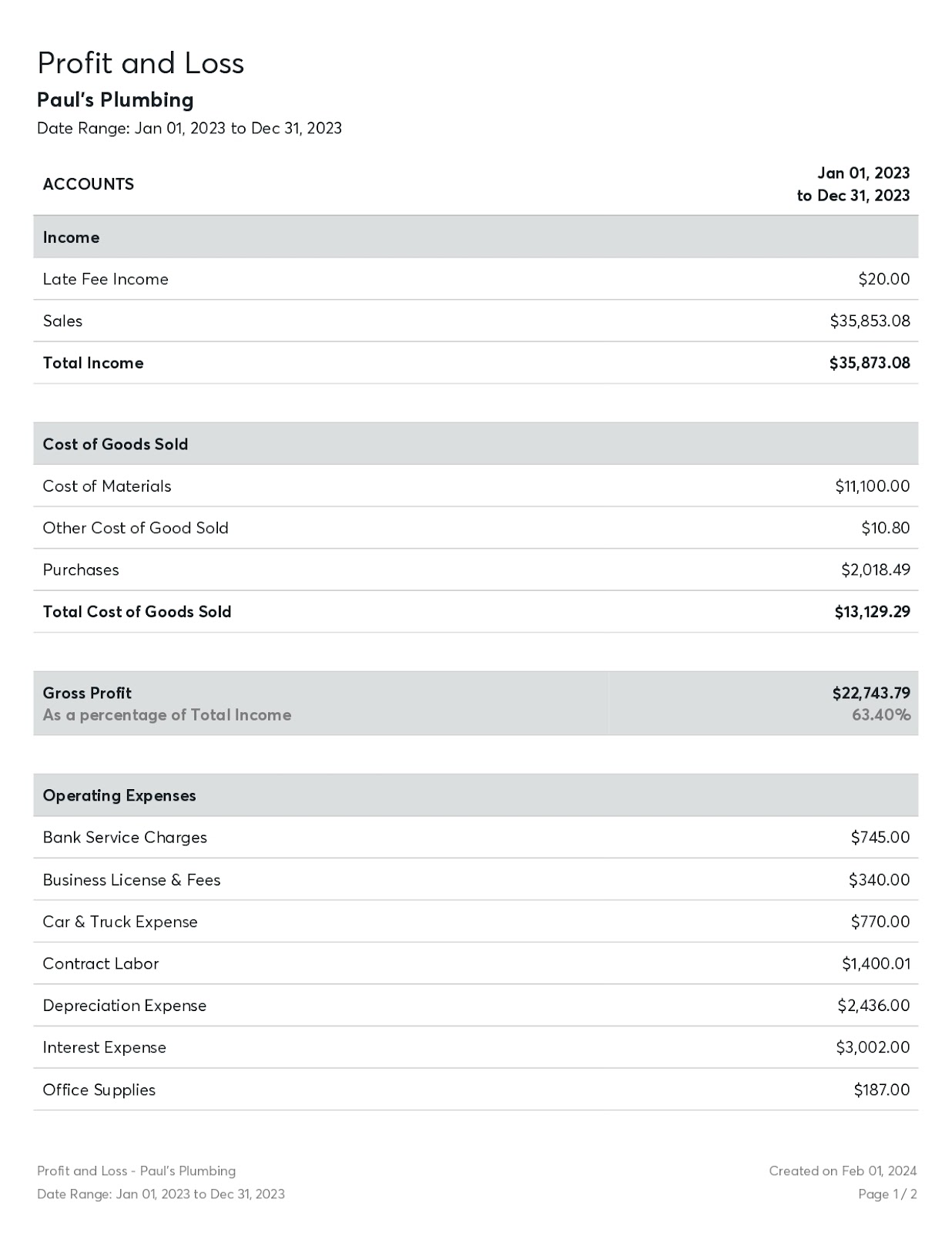

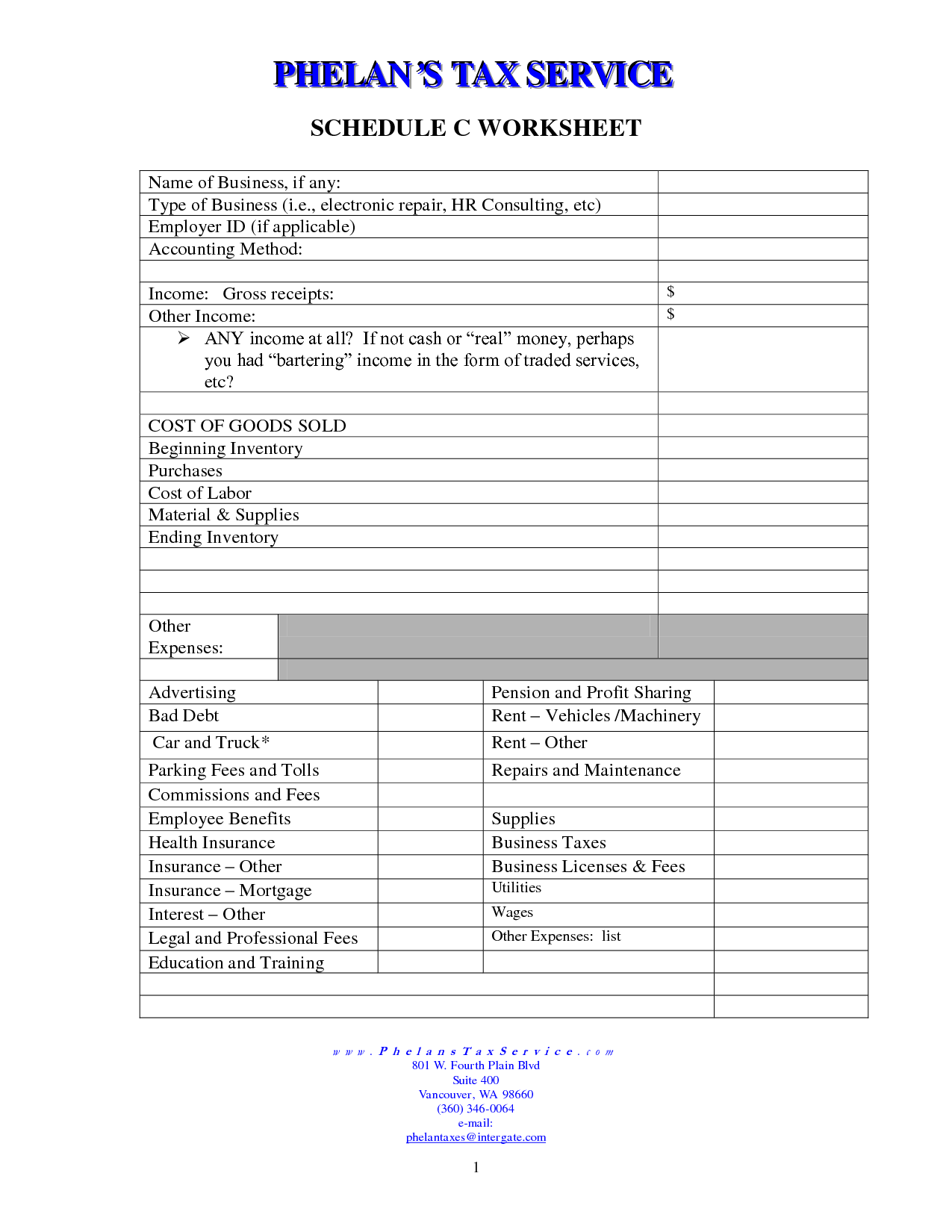

Websep 19, 2022 · schedule c is the linchpin of your independent contractor taxes. It's the form that lets you claim business expenses regardless of whether you itemize your tax. Webfilling out schedule c for your doordash business is a relatively straightforward process. Here are the key sections and questions you need to pay attention to: Webfilling out a schedule c is one of the most effective ways for doordash contractors to pay only what they owe in taxes. Documenting their business income and expenses ensures. If you want to deduct expenses related to your income then you will need. Webuse schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your.

Related Posts

Recent Post

- Sigalert Map

- Zillow Atlanta Georgia

- Food Stamp Office Fort Payne Al

- Muldraugh Project Zomboid

- Fox Journalist Firedpodcast Personal Html

- Vitamin Shopee

- Vca Animal Hospital Locations

- Imdb Thor Dark World

- Cable In My Area By Zip Code

- Lexington Ky Herald Leader Obits

- Motorcycle Club Sons Of Silence

- Is Calcasieu Parish Schools Closed Tomorrowabout Html

- Fish Forecast Georgia

- Inmate Search Sjsoabout Html

- Cvs Tb Testing

Trending Keywords

Recent Search

- Zillow Lone Pine Ca

- Twitter Luke Combs

- 72166 Chase Fraud Text

- Amigone Obituaries

- Biomat Usa Whitehall Photos

- Bjs Job

- Quest Lab Pickup

- Larry Potash Wgn News

- Cromartie Miller Funerals Cremations Obituariespitrest Html

- Fl Smione Card

- All Of The Blooks In Blooket

- Green Bay Press Gazette Obituaryregister Html

- Umiami Early Decisionabout Html

- Obituaries For Today In Athens Banner Herald

- Spiderman X Scarlet Witch Fanfiction

/GettyImages-174038203-5a4d1e6de258f80036c28e70.jpg)

:max_bytes(150000):strip_icc()/ScheduleD2022IRS-11353a1e824e41a9a83f83e39fd0f879.jpg)

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)